In other words, if proof and identification procedures take a long time, are too tedious or too scrutinizing, the customer may possibly experience uneasy and take their business elsewhere. Thus, it’s very important to apply proof and verification procedures which are complete and accurate while however respecting the privacy of the buyer and sustaining transaction convenience Best place to buy Scannable Fake IDs.

Consumer relationships are evolving. With each moving year, innovations in ease, security and cost-effectiveness revolve around transactions done online. But as the advantages of on line transactions multiply, therefore do the risks taken by both business and consumer.

Hackers, scammers and personality robbers develop new approaches to exploit both events just as rapidly while they adjust to guard themselves from attack. It is important in today’s market for those participating in on line business to take action to guard themselves, their consumers and their investments with solid personality proof and verification tools.

When looking for the correct process to guard your passions, the big difference between these two components may become obscured, specially with regards to government regulation compliance. Actually, the recent delay of the Federal Business Commission’s (FTC) Red Banners Principle implementation time from August 1 to November 1 was a direct result of confusion around for whom, and from what capacity, submission procedures should be implemented. It’s very important to all business homeowners to comprehend and consent to the level of personality defense that’s suited to their needs.

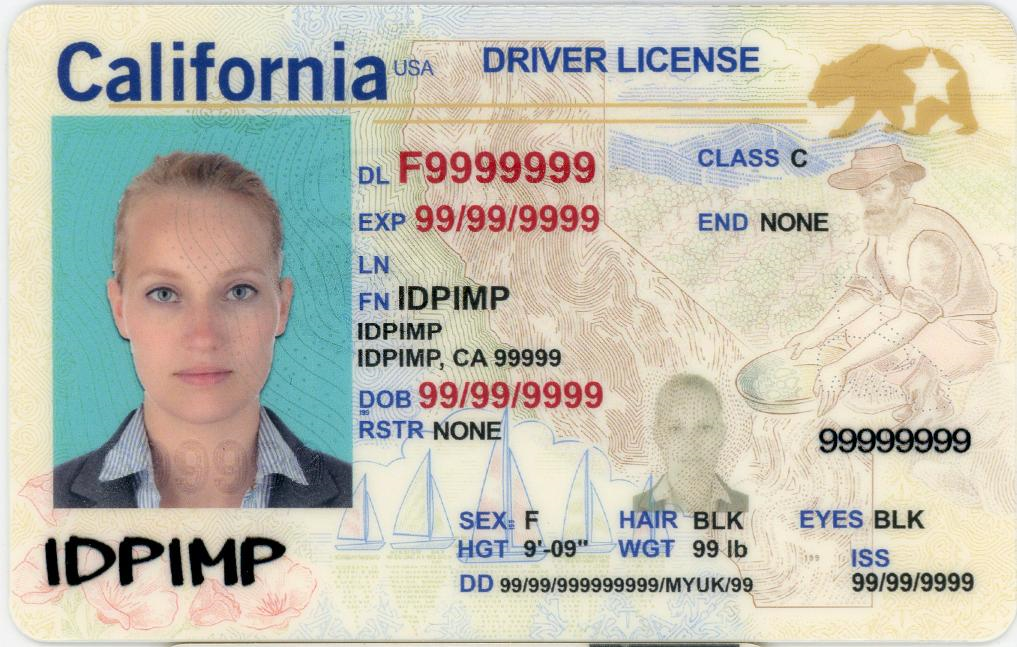

When you have actually been requested to display a driver’s licence, enter a Social Security number, or provide different qualifying personal information before a transaction could proceed, you have skilled personality verification. Quite simply, personality proof is simply asking a consumer presenting a questionnaire of identification out of their wallet to prove who they are.

While personality proof alone is needed for a few corporations and is simply an additional later of security for others, it is perhaps not foolproof. From artificial IDs to lavishly designed cons, those who might exploit corporations are quick to work around personality verification. And those workarounds signify corporations, consumers and confidential information might be at critical risk. That’s wherever verification comes in.

When verifying a consumer’s personality personally, there can be nonverbal cues or simple inconsistencies that alert a business operator to probable personality fraud. But, those cues are invisible for on line transactions. On earth of total buy automation, if the buyer can trick the security process, the buyer can set your business at risk.

Personality verification not only needs consumers to supply qualifying personality information, in addition, it needs the patient to supply information that’s perhaps not easily taken or guessed. They’re often called “out-of-wallet” questions and can question any such thing from the titles of household members, to the total amount and volume of a previous loan payment. Out-of-wallet questions refer to information just the real person could know.

Applying both personality proof and verification in to your process protects your business from personality scam and guarantees submission with the “Know Your Customer” amounts of government security regulations. But, there’s excellent value in how these ideas are implemented in to your transaction process.